Weekly magazine Shukan Post reported in their April 30 issue on an interesting trend in the currently slow world of real estate investment, digging into the popularity of so-called “Loveho Funds.”

About as Japanese as a REIT can get, the funds work by grouping the capital of interested parties together and purchasing love hotels, instead of more typical investment property such as condominiums. Explains financial planner Masayuki Kidaira, “While condos and office space have their earnings determined by rent prices, love hotels are a business where earnings can be two or three times as much.”

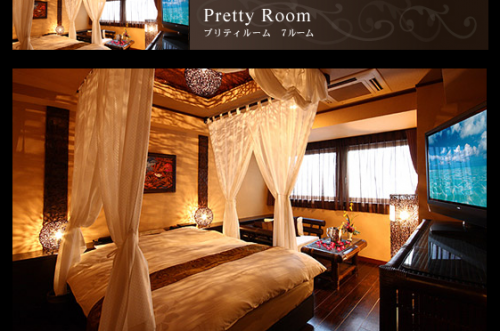

One well-known fund is Initia Star Securities‘ “NEO HOPE” series of seven “leisure hotel” funds that began in 2008. Investments cost as little as 100,000 or 500,000 yen, and properties are purchased, renovated and run with investor money over the course of three years, distributing dividends twice per year. Yearly dividend yield ranges from 5 to 8%, much higher than a typical investment’s 2-3%.

But why do the hotels make such a good investment? First of all, they’re profitable: Love hotels employ a system encouraging use for only two or three hours at a time making for a high customer turnover. The business is also widely known as being one of a few lucky “recession-proof” industries. They’re also cheap to run, with the ability to employ a small number of foreign laborers because customers rarely interact with the employees.

Moneyzine also points out that, because love hotels operate under unusual regulations and commercial practices, the hurdle is high for those trying to enter with no experience. On top of that, very few large corporations are willing to invest a large amount of money in producing a chain of hotels because of the possible negative effect it would have on the company’s reputation. Thus, the relatively small number of hotel operators live without fear of new competition stealing their business.

Despite corporate hesitation, in recent times love hotels have lost much of their seedier image. In areas like Tokyo, “fashion” or “boutique” hotels offer stylish and exotic accommodations, brand-name amenities, and now give patrons a key so they may go in and out–all under the traditional “rest” and “stay” payment systems.

According to a 2006 Forbes article, however, love hotels and securities have met before. This time around, however, with their improved image and the sagging real estate market they may prove to be more attractive than before.

Very interesting article. How/where can we invest? Recession proof indeed!

that looks familiar. I was at the Bali An in Shinjuku last week with my girlfriend. It seemed really nice after walking through those streets seeing fights which scared me they’ll get really serious. And the endless clubs that creeped me out. Then this nice love hotel… I thought how strange and out of place it was. Now I know…